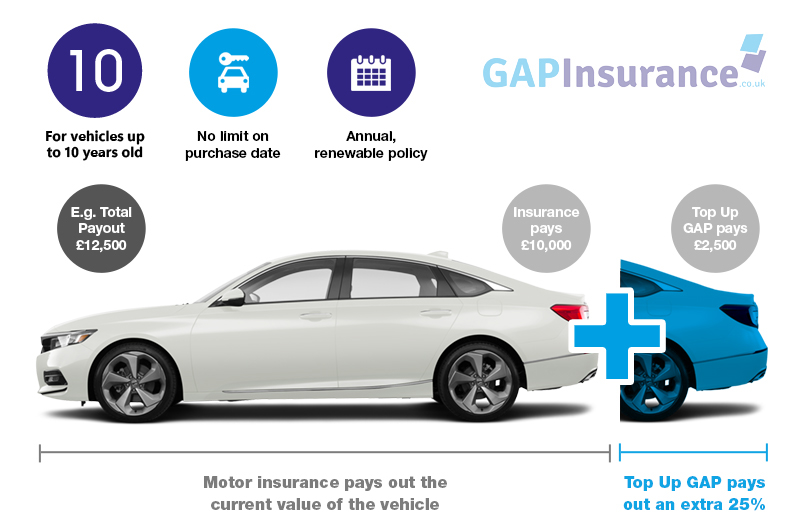

What is Top-Up GAP insurance?

Top-Up GAP insurance is an annually renewable GAP insurance policy which, in the event of your vehicle being declared a Total Loss (written off) through accident, fire, theft, or flood, will aim to pay you up to an additional 25% of what your motor insurer paid out.

Largest claim paid

£10,000

Average claim paid

£4,543

How does Top-Up GAP insurance work?

In the event of your vehicle being declared a Total Loss (aka "written off") as a result of an accident, fire, theft or flood, your comprehensive Motor Insurance policy would normally only pay out the market value of the vehicle at the time of loss. Top-Up GAP insurance will aim to pay you up to an additional 25% of what your motor insurance policy pays out.

Examples:

- Your car is written off and your motor insurance policy pays out £20,000 less a £750 excess = £19,250. Top-Up GAP insurance pays you £4,812.50 (25% of £19,250 = £4,812.50 + £750 excess cover = £5,462.50)

- Your car is written off and your motor insurance policy pays out £40,000 less a £1000 excess = £39,000. Top-Up GAP insurance pays you £9,750 (25% of £39,500 = £9,750.00 + £750 excess cover = £10,500. Payout limited to max' £10,000)

If you need assistance determining whether this type of cover is suitable for your needs, please contact us.

Policy documents

Add a little TLCc to your GAP insurance:

Total Loss Courtesy Car

If your vehicle is damaged in an accident, your motor insurance policy will normally provide you with a courtesy/hire car whilst the damage to your vehicle is being assessed.

If they determine that your vehicle is repairable, you would normally have the use of that courtesy car for the duration of the repairs.

However...

If they decide that the damage to your vehicle is beyond repair and subsequently declare it a Total Loss (they write it off), you would then not normally be entitled to their courtesy car any longer (unless you've paid them an additional premium for such entitlement) and, it would be withdrawn: leaving you without the use of a vehicle.

Depending on how much longer they take to settle your claim, you might be without a vehicle for a number of days - or even weeks!

Building in Total Loss Courtesy Car cover (TLCc) to your GAP insurance policy with us, means that in the event your car is declared a Total Loss, we will provide you with a courtesy car for you to use for up to 28-days.

TLCc Cover Features:

The car provided:

- Will be of a similar sized engine to Your vehicle that was deemed a Total Loss (limited to a maximum of a 2.0 litre manual car or equivalent)

- Will be insured. Please note that an excess (normally £250) will apply to accidents/claims occuring during your use of the courtesy car. Exact terms will confirmed prior to you accepting delivery of it.

- Will be able to be delivered to and collected from your home or place of work.

For more information please review the Ts & Cs of our GAP insurance policies here, or generate a quote.

Do I need Top-Up GAP insurance?

GAP insurance is an entirely optional form of insurance and some people will have a greater need for it than others.

Without GAP insurance in force, if your car is written off, you'd only have your motor insurer's valuation of the vehicle coming your way. If you have finance outstanding on your written-off vehicle, your motor insurer's valuation of the vehicle may not be sufficient to clear the outstanding balance, in which case, you'd have to use your own funds to both clear the remaining finance on the written off vehicle and fund a replacement vehicle.

Of course if you had no finance outstanding at the time of write-off, then in theory you could use your motor insurer's valuation of the vehicle to buy a vehicle of a similar age, condition and mileage as your vehicle at the time it was written off but, if you wanted anything newer or better etc, you'd have to use some of your own funds to cover the difference.

Top-Up GAP insurance would aim to top-up your motor insurance pay-out by up to 25% and includes cover for up to £750 of any excess deducted by your motor insurer. If you have finance outstanding this additional money could come in useful by either contributing more towards clearing the finance than you would otherwise have been able to pay without it, or, by leaving you with more funds to go towards the cost of your next vehicle.

In short... if you can comfortably afford to stand the combined cost of clearing any finance outstanding (where applicable) and replacing your vehicle in the event it's written off, you probably don't need GAP insurance. However if you could not comfortably afford this or, you'd prefer that your own savings were not 'hit' by the cost of replacing your vehicle if it was written off, therein lies the need for Top-Up GAP insurance.

Am I Eligible for Top-Up GAP insurance?

You can buy Top-Up GAP insurance to cover a New or Used car that:

- Is covered by a comprehensive motor insurance policy.

- You are the owner or registered keeper of.

- Is less than ten (10) years old at the start date of this policy.

- Has not previously been declared a Total Loss and is not already the subject of a previous incident or existing motor insurance claim which could yet result in it being declared a Total Loss.

- Is registered in the UK.

- Is worth no more than £80,000 at the start date of the policy.

- Is not a commercial vehicle.

- Is not being used for: rallying, racing, any competitive events, off road (including green laning), emergency services use (blue lights), hire (including private hire, taxis and chauffeur) or for driving school tuition.

- Is not already covered by a GAP insurance policy.

- Was bought: cash outright, personal loan (secured or not), financed by way of a HP, PCP, or Conditional Finance Agreement.

- Is not a specifically excluded vehicle.

- Is not a van, car derived van, motorcycle, motorhome or campervan.

So long as you:

- Are a permanent resident of the United Kingdom (England, Wales, Scotland, Northern Ireland, Channel Islands and the Isle of Man), or a UK registered company.

You can NOT buy Top-Up GAP insurance for a vehicle that:

- Is not covered by a comprehensive motor insurance policy.

- You are not the owner or registered keeper of.

- Is more than ten (10) years old at the start date of this policy.

- Has previously been declared a Total Loss or, is already the subject of a previous incident or existing motor insurance claim which could yet result in it being declared a Total Loss.

- Is not registered in the UK.

- Is worth more than £80,000 at the start date of the policy.

- Is a commercial vehicle.

- Is (or will be) used for: rallying, racing, any competitive events, off road (including green laning), emergency services use (blue lights), hire (including private hire, taxis and chauffeur) or for driving school tuition.

- Is already covered by a GAP insurance policy.

- Is the subject of a Contract/Lease Hire agreement.

- Is a specifically excluded vehicle.

- Is a van, car derived van, motorcycle, motorhome or campervan.

Key features of Top-Up GAP insurance

- Pays you up to an additional 25% of your motor insurance pay-out in the event that your car is declared a Total Loss

- Available for a car up to 10 years old, regardless as to how long ago you purchased it.

- Ability to cancel the policy at any time and receive a daily pro-rata refund of unused premium (a cancellation fee may apply).

- CASH payout to you rather than to a nominated dealer, leaving you free to choose the provider of your replacement vehicle.

- OPTION to include the provision of a courtesy car for you to use for up to 28-days in the event your vehicle is a declared a total loss.

- ALL named drivers on the Motor Insurance policy, covered.

- Available for cars worth up to £80,000.

- Underwritten by Arch Insurance (UK) Ltd.

- Pays up to £750 towards the excess on your Comprehensive Motor Insurance policy.

- FREE transfer of any unused premium towards the cost of a new policy on a replacement vehicle.

- Annually renewable policy.

- FREE policy amendments.

| Feature | Details |

|---|---|

A-Rated Insurer? |

|

ALL named drivers on your motor insurance policy, covered? |

|

NO Pre-Approval clause with penalty? |

|

Total Loss Courtesy Car available? |

Subject to an additional fee being paid.

|

Initial Cooling Off Period? |

30-days |

Pro-Rata rebate of unused premium if you cancel outsde of the initial Cooling Off Period? |

Daily Calculation |

Pays out in cash to the policyholder? |

After all parties with an interest in the vehicle have been paid (e.g. a finance company), any/all excess funds are paid directly to the policyholder leaving them free to use those funds against the cost of sourcing any vehicle from any dealership of their choice. |

| Transferable? If you sell your vehicle and have not claimed on your GAP insurance policy, can the unused portion be transferred forward on a new vehicle? |

Yes - we will update your policy with your new vehicle details. No cancellation, transfer or admin fees will apply. |

| Will pay towards your Motor Insurance excess in the event of a successful Total Loss claim? | £750 |

| Maximum age of vehicle that can be covered? | 10 years old |

| Maximum vehicle value? | £80,000 |

| Maximum Claim Limit available? | £10,000 |

| Maximum duration of cover available? | 1 Year Renewable

|

Is there a cancellation Fee if cancelled outside of the initial Cooling Off Period? |

£15.00 Waived if a new policy is purchased.

|

How long after taking delivery of the vehicle, do have to buy Top-Up GAP insurance? |

Any time

(As long as the vehicle is less than 10 years old at the start date or renewal date of the policy)

|

Allows for vehicles to be modified? |

Recent Top-Up GAP insurance claims

Below are a selection of our most recent Top-Up GAP insurance claims:

Land Rover Range Rover Evoque

- Policy Cost:

- The policy cost £156.80 (2.16% of the amount the policy paid out.)

Vauxhall Mokka

- Policy Cost:

- The policy cost £182.40 (12.10% of the amount the policy paid out.)

Land Rover Range Rover Velar

- Policy Cost:

- The policy cost £211.68 (4.46% of the amount the policy paid out.)

BMW 5 Series

- Policy Cost:

- The policy cost £211.20 (6.08% of the amount the policy paid out.)

Land Rover Discovery Sport

- Policy Cost:

- The policy cost £211.20 (6.55% of the amount the policy paid out.)

Land Rover Range Rover Evoque

- Policy Cost:

- The policy cost £132.80 (2.20% of the amount the policy paid out.)

Toyota Yaris Cross

- Policy Cost:

- The policy cost £156.80 (2.47% of the amount the policy paid out.)

BMW i8

- Policy Cost:

- The policy cost £99.96 (1.00% of the amount the policy paid out.)

Tesla Model 3

- Policy Cost:

- The policy cost £260.06 (3.91% of the amount the policy paid out.)

Audi A3

- Policy Cost:

- The policy cost £142.13 (2.69% of the amount the policy paid out.)